Overhead Set Up

To add or edit your default job costing information, you will want to go to the settings menu in the upper right hand corner, down to Overhead Set Up in the Items column. This is where you will begin setting up the building blocks of your Arborgold job costing; Overhead Recovery & Desired Profit, Avg. Employee Unit Cost/Price, and Material for Job/Service Costing.

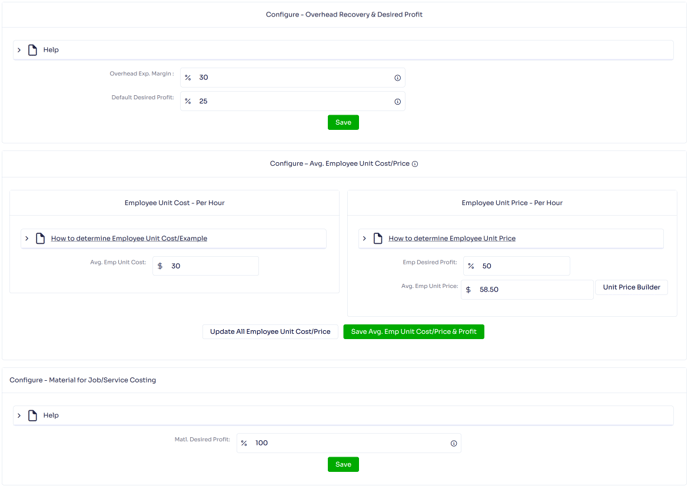

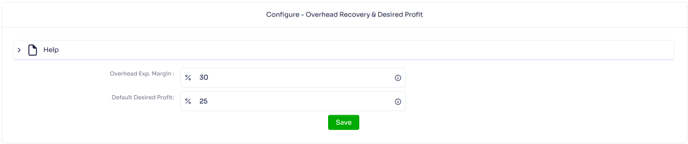

Overhead Recovery & Desired Profit

Overhead Exp. Margin - represents the expenses that are not directly related to performing the service such as: administrative expenses, marketing expenses, facility expenses, indirect job cost, gas, truck maintenance, etc. This is utilized in your resource price builders, and in your job's 'Profit & Loss' chart.

You can calculate this number using the equation Overhead Exp. Margin = Operating Expenses / Revenue. If you are not sure where to find those numbers you can find them on your Profit/Loss Statement within QB.

Default Desired Profit - represents the percentage of Net Profit you would like to make once the service has been completed. This is utilized by the sliding scale rates and the charge per unit service price builder.

Think of this as the percentage of the price you would like to make as profit after taking into account the direct service cost and the overhead expenses. If you do not already have a number in mind for this, you can calculate using the equation Default Desired Profit = ((Average Subtotal - (Average Direct Cost + Average OH Cost)) / Average Subtotal).

Once you have entered in these numbers, you will want to click on the green save button below.

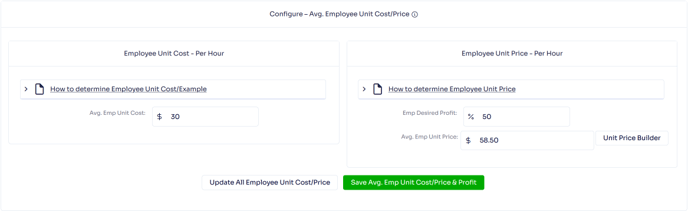

Avg. Employee Unit Cost/Price

This section allows you to create an average employee unit cost and unit price for your company as a whole. This is the recommended method, as estimating based on specific individual employees often leads to greater fluctuation in estimated versus actual costs and prices, and inaccurate job/service costing.

Employee Unit Cost - Per Hour - represents the average cost of employee labor to you, the company, for one hour.

You can calculate this number using the equation Avg. Emp Unit Cost = Total Labor Expenses / Total Employee Hours Worked. If you are not sure where to find those numbers you can find them on your Payroll Report within QB.

Employee Unit Price - Per Hour - represents the average price of employee labor to your client, the customer, for one hour. Note that you will want to enter this in even if you are not using Time and Material pricing, as it can help inform your salesperson as to whether or not the price needs to be adjusted based on the resources to hit a specific profit margin.

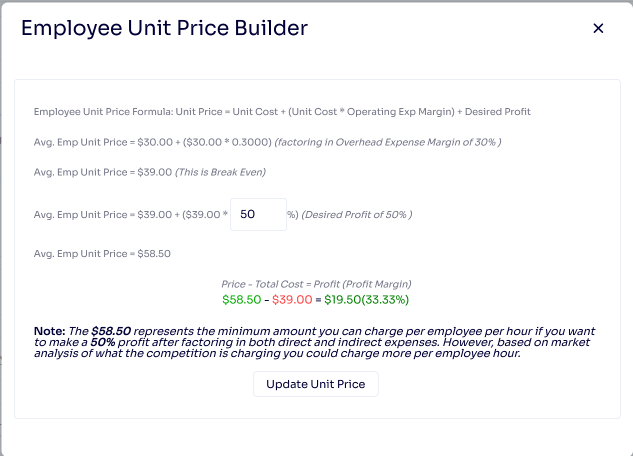

To determine this number, you will want to enter in your Emp Desired Profit, and then either click on the Unit Price Builder tool, or calculate the number yourself.

You can calculate this number using the equation Avg. Emp Unit Price = Avg. Emp Unit Cost + (Avg. Emp Unit Cost * Operating Exp Margin) + ((Avg. Emp Unit Cost * Operating Exp Margin) * Emp Desired Profit).

You can also use the Employee Unit Price Builder to have the system calculate it for you. This will take the Overhead Exp. Margin previously entered, the Avg. Emp Unit Cost, and the Emp Desired Profit to calculate out the Avg. Emp Unit Price.

Once you have entered in these numbers, you will want to click on the green 'Save Avg. Emp Unit Cost/Price & Profit' button below in order to save the information to this page. If you would like to update all of the employees currently in the employee listing in the settings menu, you will also want to click on the 'Update All Employee Unit Cost/Price' button to the left.

![]()

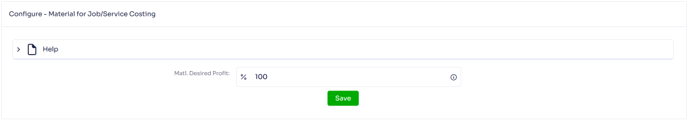

Material for Job/Service Costing.

Matl. Desired Profit - represents the default desired profit used for the Material Unit Price builder for the Material item.

Written by Betsy Rainey 06/05/2023