How to Change the Tax Level

Learn how to change the tax level and how it works with your clients and services.

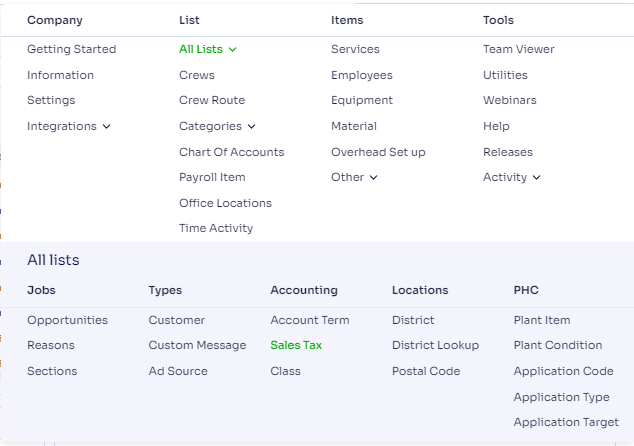

Let's take a look at how you can create and set up your tax level within Arborgold. Start off in the Dashboard, go up to the Gear COG ![]() . Go to All Lists and come down to Sales Tax under Accounting. This is where you're going to set up your tax levels.

. Go to All Lists and come down to Sales Tax under Accounting. This is where you're going to set up your tax levels.

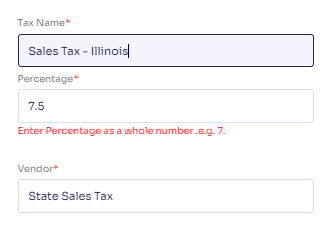

Click the +Add New button to create a new Sales Tax. Give it a name and give it a percentage.

Now there could become some confusion here with entering the percentage as a whole number. People get confused with this a lot of times. What it's meaning is that it wants you to enter in the percent as I have it here instead of a decimal point. So it wants you to enter the whole number, whether 7.5 percent or 7.25, or 8.75. Whatever this percentage is, that's how you need to enter it in there. I'll leave mine 7.5. The Vendor Name here is referencing this same tax level within your QuickBooks. So you need to make sure that you've got the same Vendor Name from Quickbooks in here, then hit save.

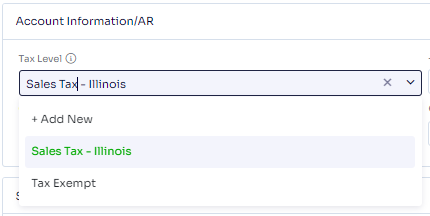

Now over to my Customers, I need to make sure that I assign a Tax Level to my customer. Scroll down over to Account Information/AR. Where it says Tax Level, this is where it's going to show your different Tax Levels. I also have the option to +Add New Tax Level from here if I want to.

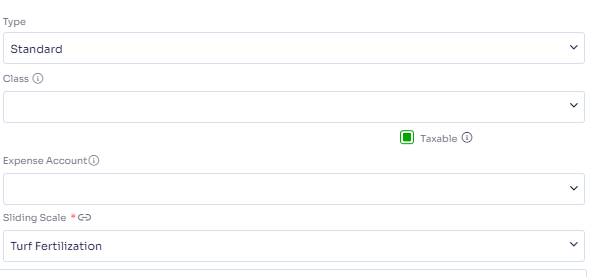

And the other spot that we need to make sure that a tax is indicated is on the Service. You have to select the Taxable box in order to charge tax for this Service.