Configure Finance Charges for Overdue Invoices

Finance Charges may be assessed per account to produce late fees based on a customer’s unpaid invoices. Finance Charges will reside on a customer’s account as a separate transaction from the original invoice. Finance Charges have a balance and may have payments submitted towards them the same as with invoices.

It should be noted that you cannot apply prepayments towards finance charges.

Note that finance charges are applied manually at the user’s discretion, on a per-account basis.

Finance Charges work with Net Payment Due days. You will need to set both defaults to have Finance Charges calculated at the correct time.

Company Default Settings

Net Payment Due Within Setting

Finance Charge Monthly Interest Rate

Introduction

Walk through how to set up, configure, and apply finance charges in Arborgold. By the end, you'll know how to establish global defaults, customize customer payment terms, and efficiently process finance charges.

Configuring Global Finance Charge Settings

Set company-wide preferences for how finance charges are calculated. These steps define the standard process unless you override them for specific customers.

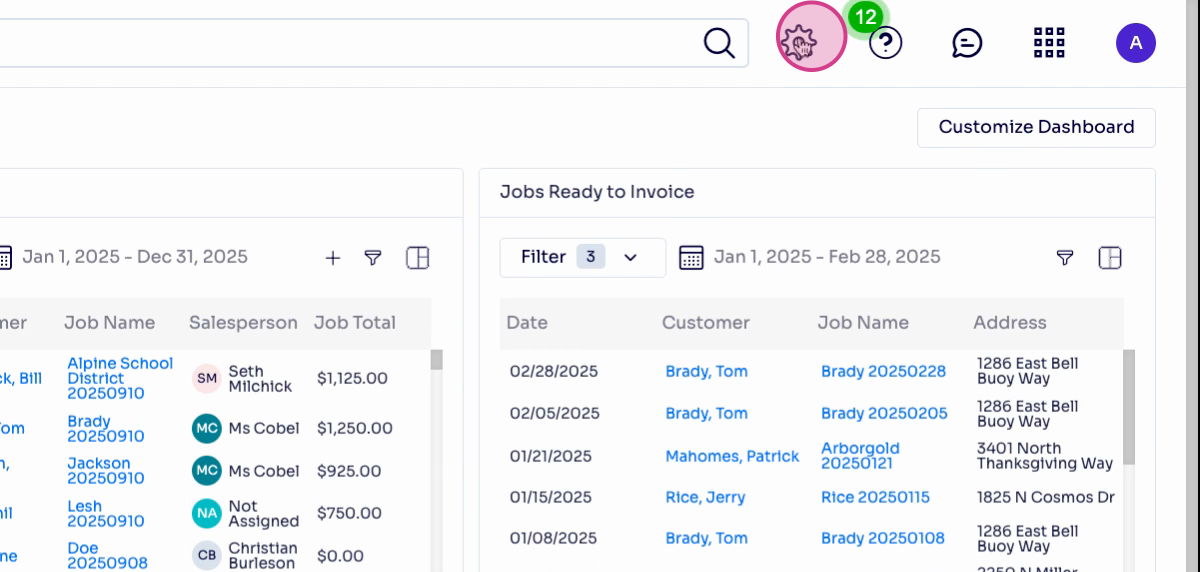

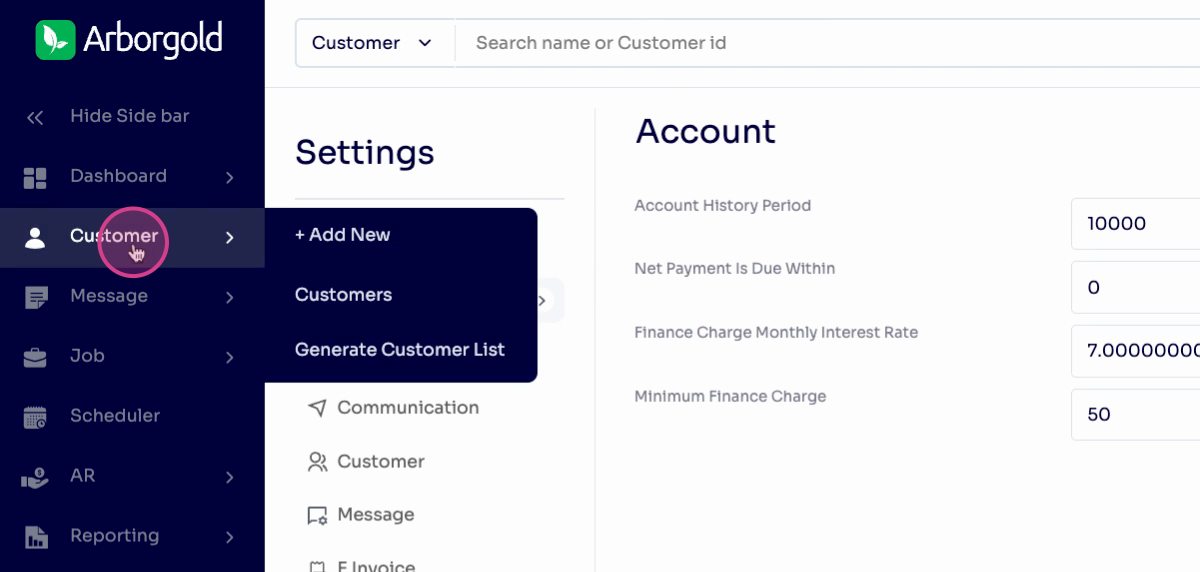

Step 1: Click the gear cog icon at the top right to access settings.

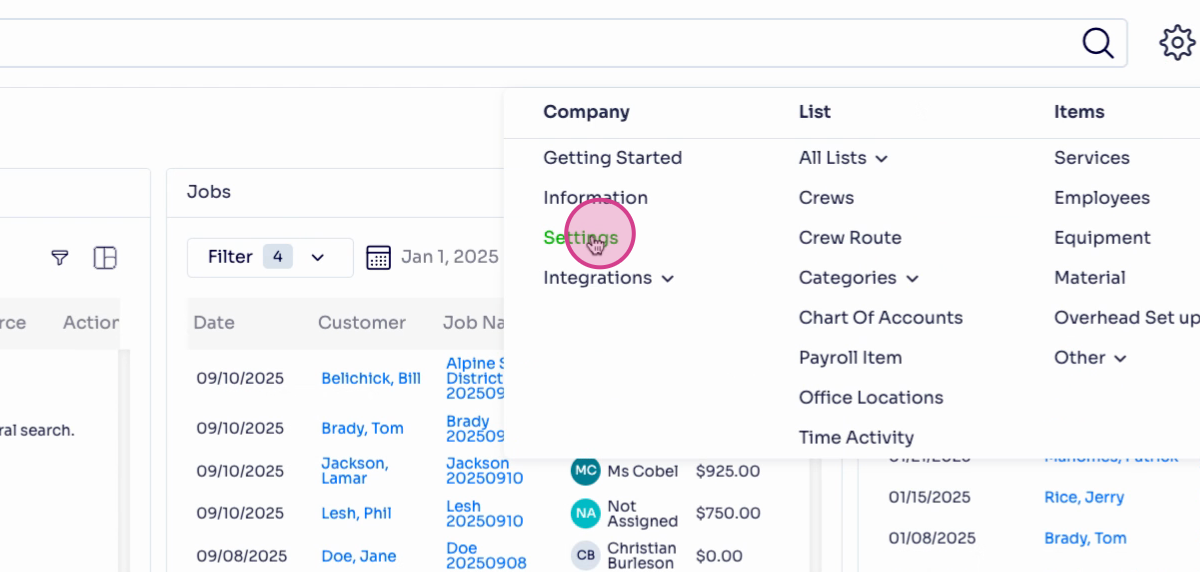

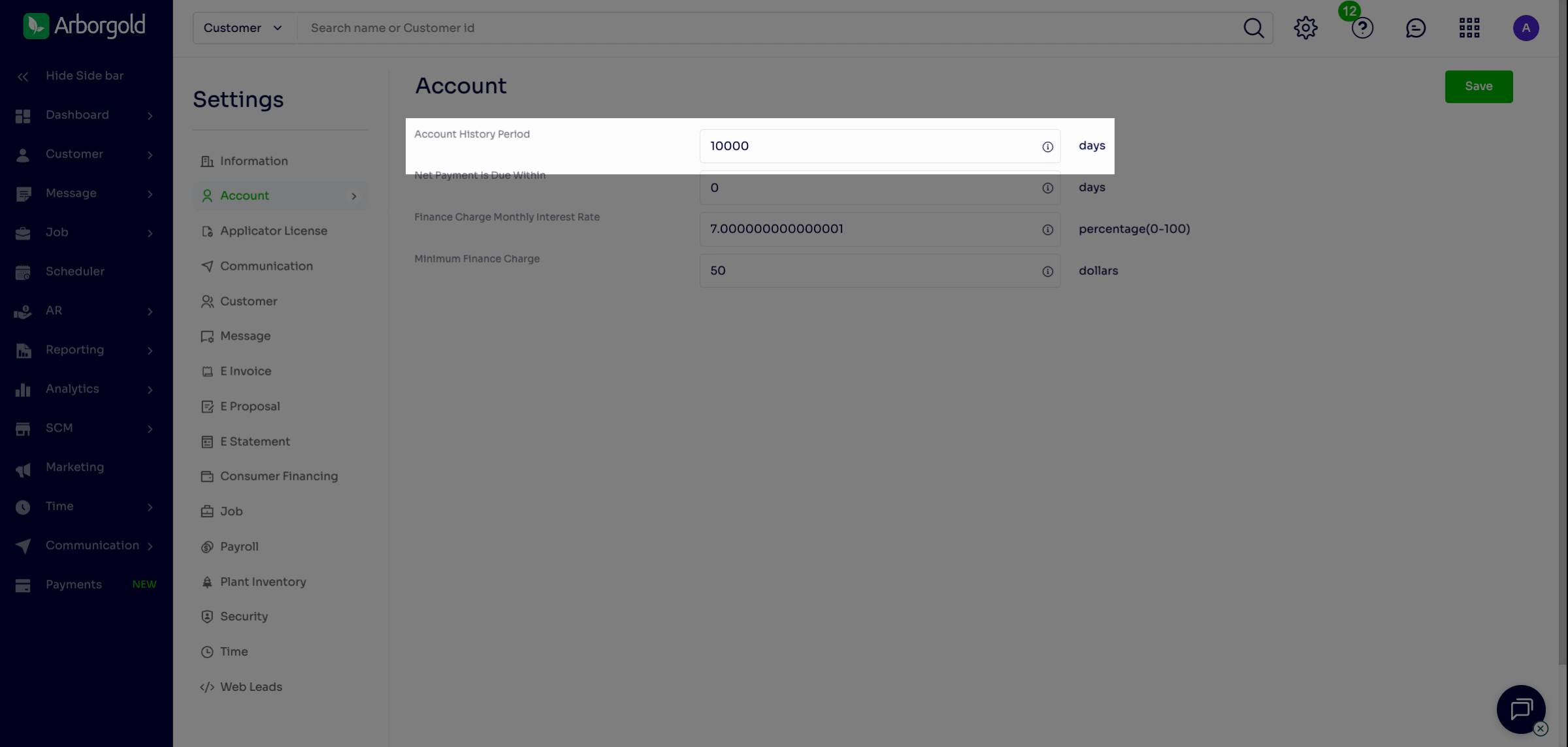

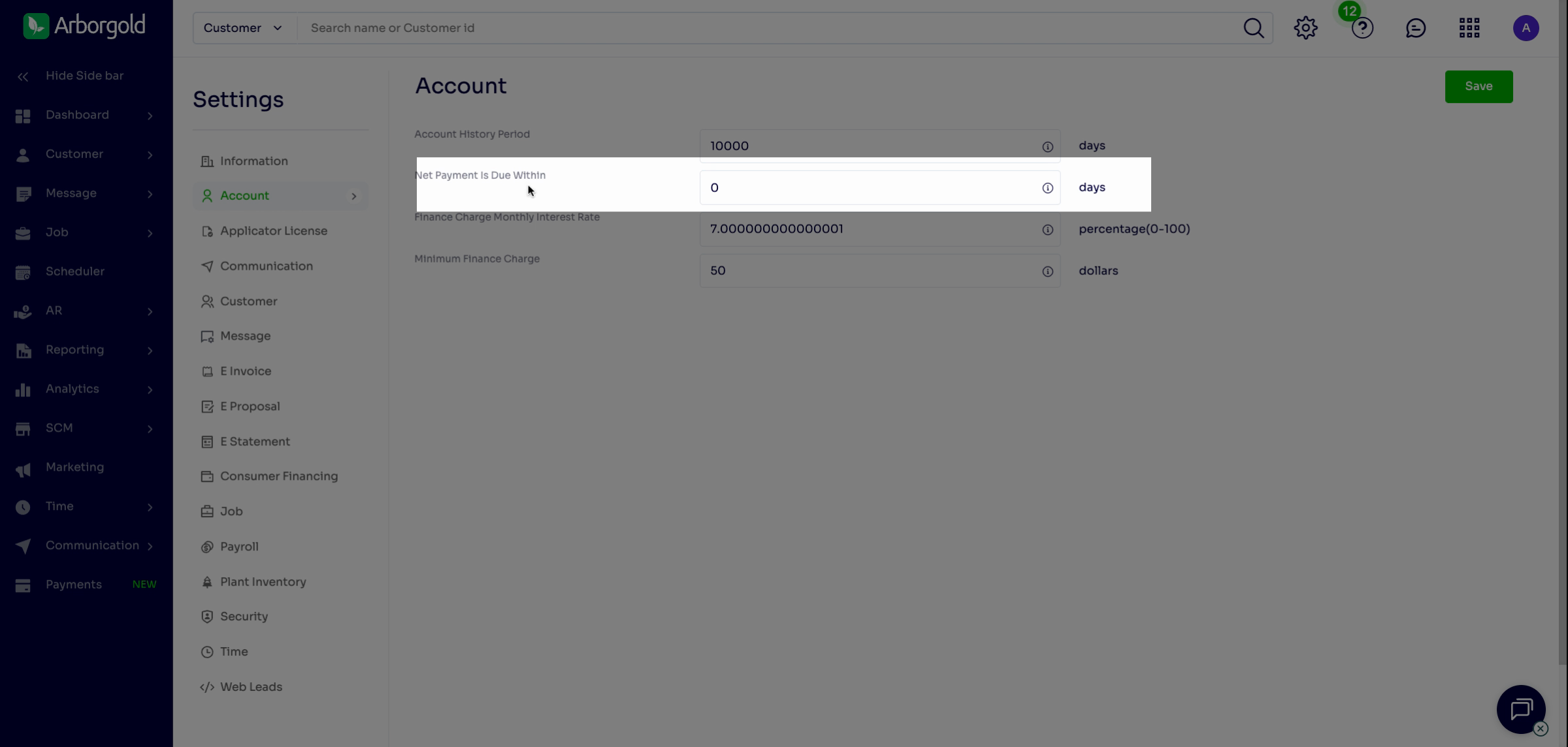

Step 2: Select Settings in the left menu under the company section.

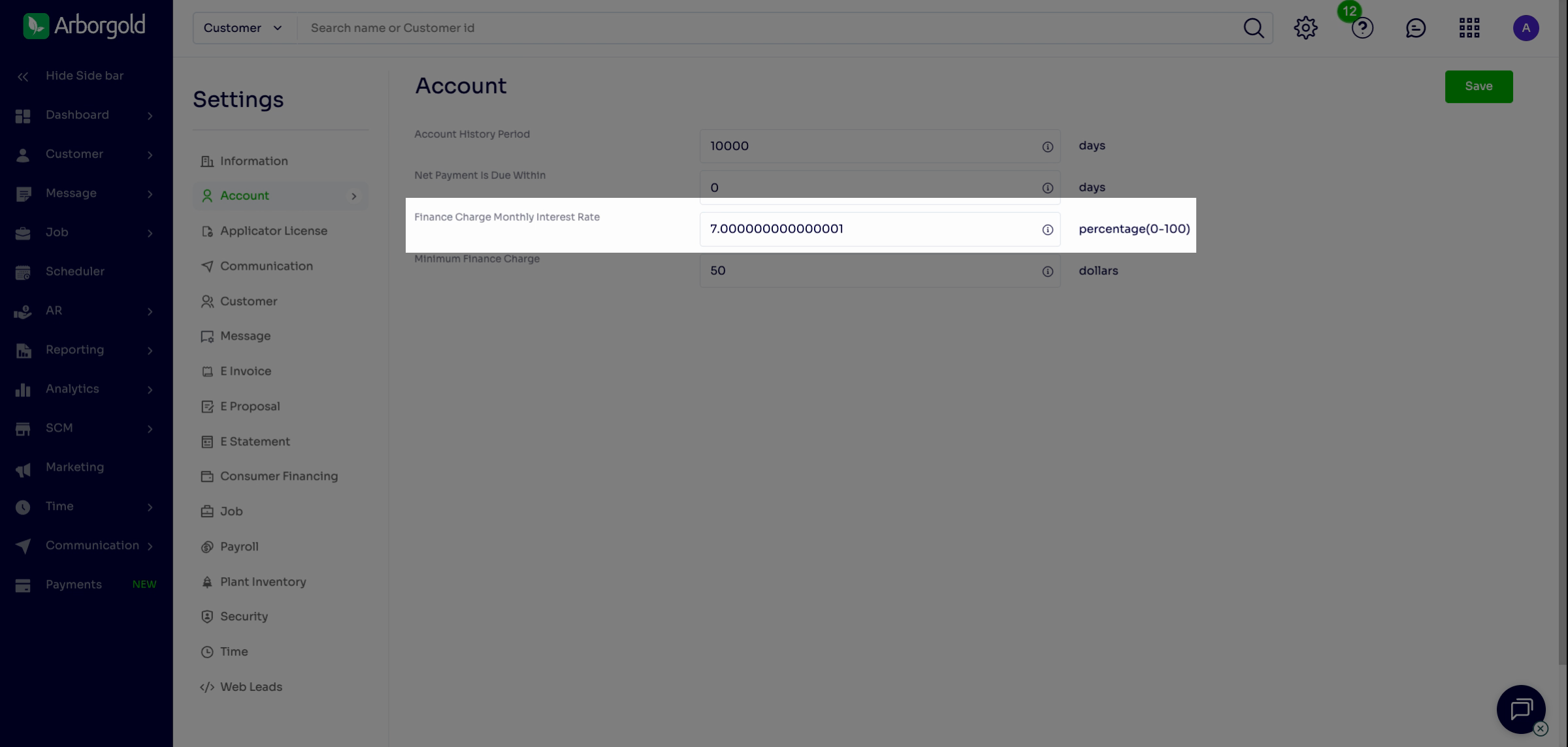

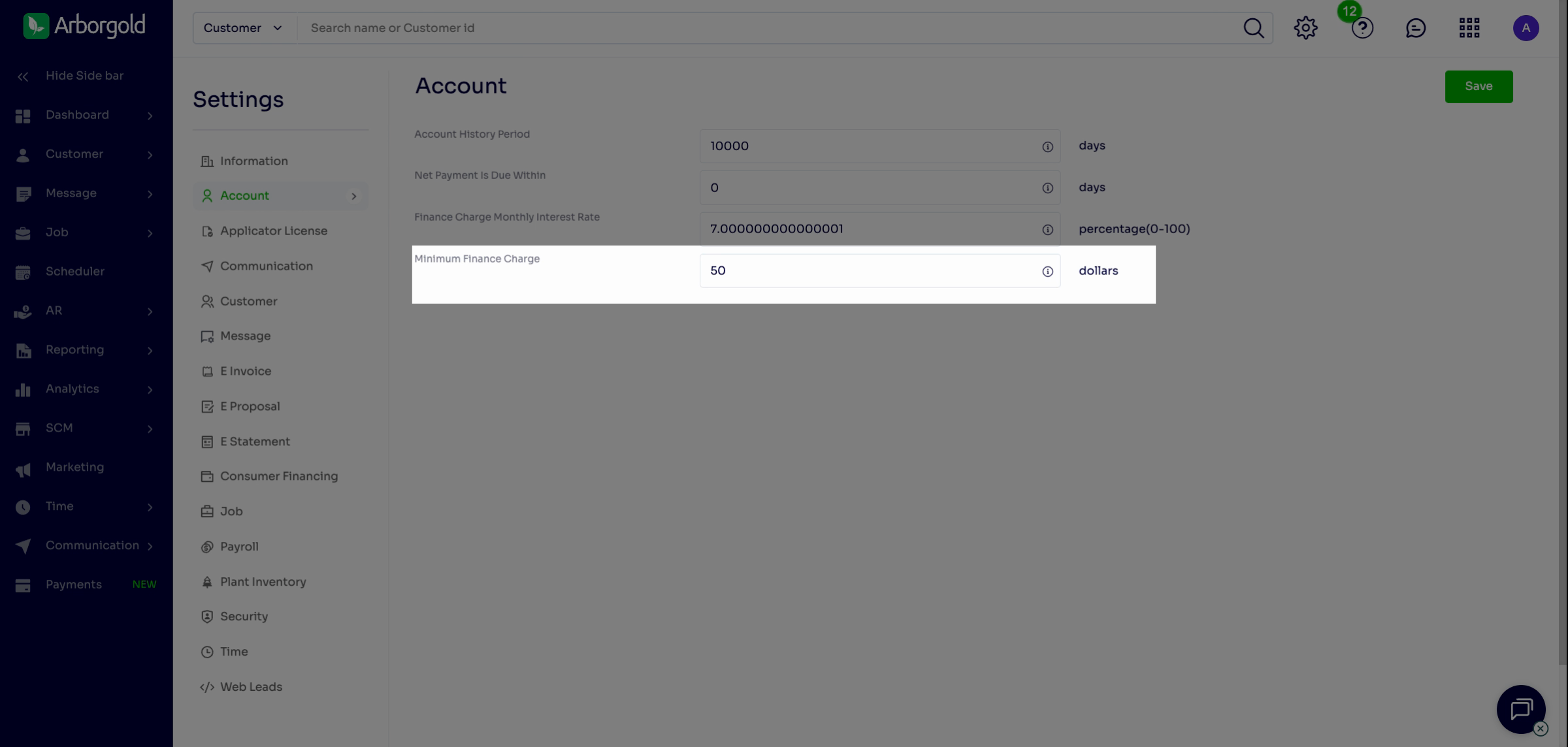

Step 3: In the account section, set Account History Period to control how many days of transactions display in a customer profile. Adjust this period based on your records needs—for example, enter 10,000 days for a thorough history.

Step 4: Set Net Payment Due Within to define invoice due dates. Enter 0 for same-day due or input another value, like 7 for a week.

Step 5: Enter a value for Finance Charge, Monthly Interest Rate to determine the percentage of overdue invoices added as finance charges.

Step 6: Specify a Minimum Finance Charge to avoid applying small fees to minor invoices. For example, set to $50 if you only want charges applied to invoices at or above this amount.

|

|

|

|

Setting Customer-Level Payment Terms

Apply custom payment terms for individual customers who need exceptions to the global defaults.

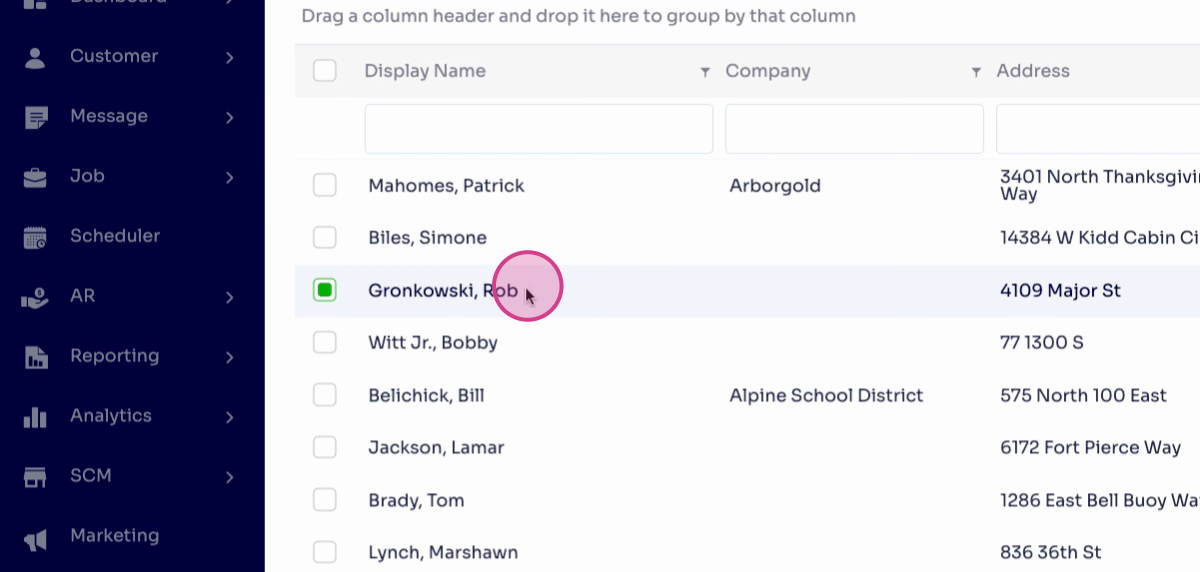

Step 7: Open the profile for the specific customer.

Step 8: Scroll to account information in their profile. Set their payment terms, such as net 30, to give them 30 days to pay.

Calculating and Applying Finance Charges

Use these steps to calculate and apply finance charges to overdue balances, for single or multiple customers.

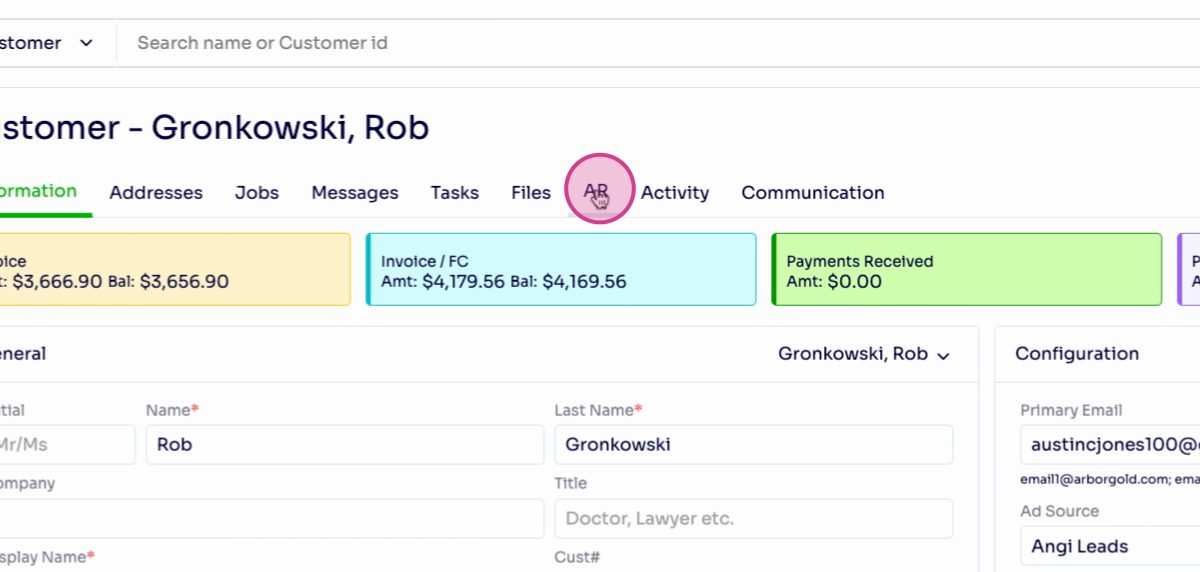

Step 9: In the customer section, open the AR tab to begin processing charges.

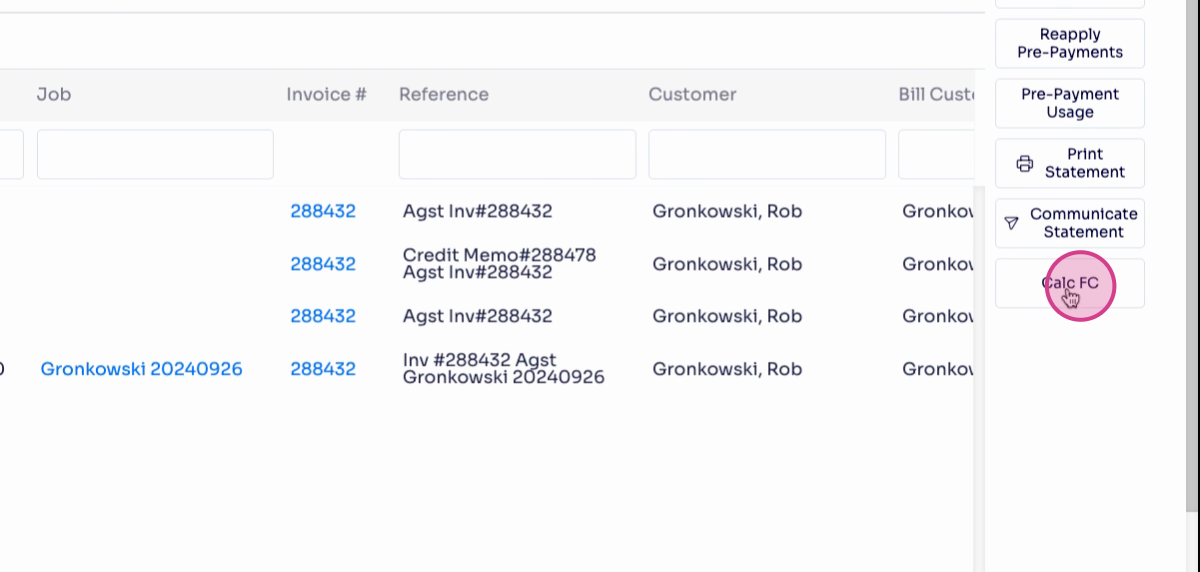

Step 10: Click Calc FC, then confirm by clicking Yes when prompted to add the finance charge.

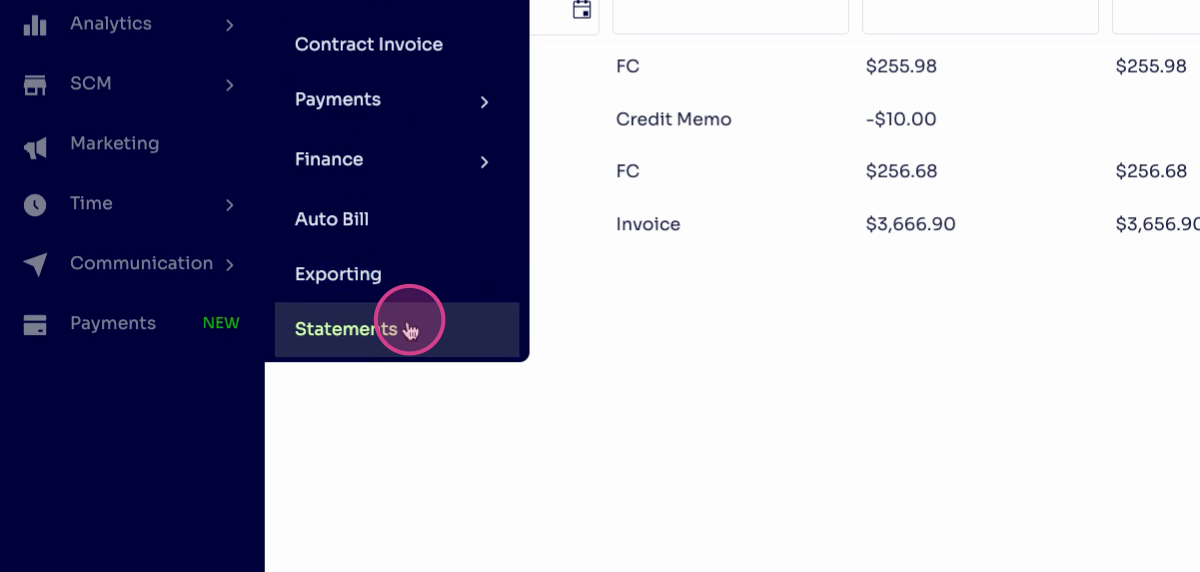

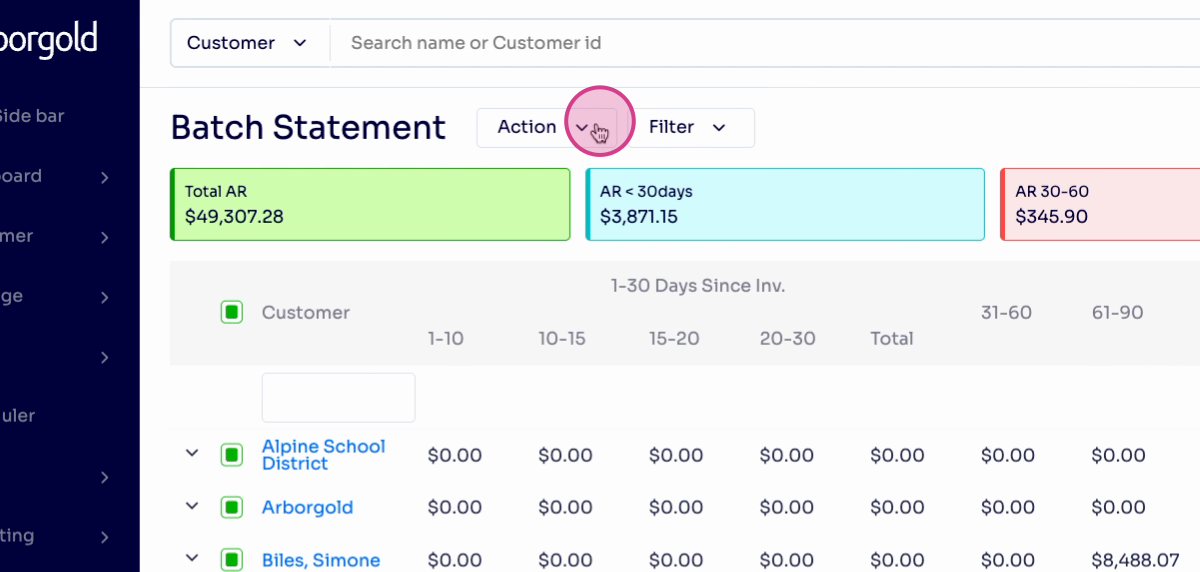

Step 11: The account balance now reflects the assessed finance charge. To apply charges in bulk, go to AR and select Statements.

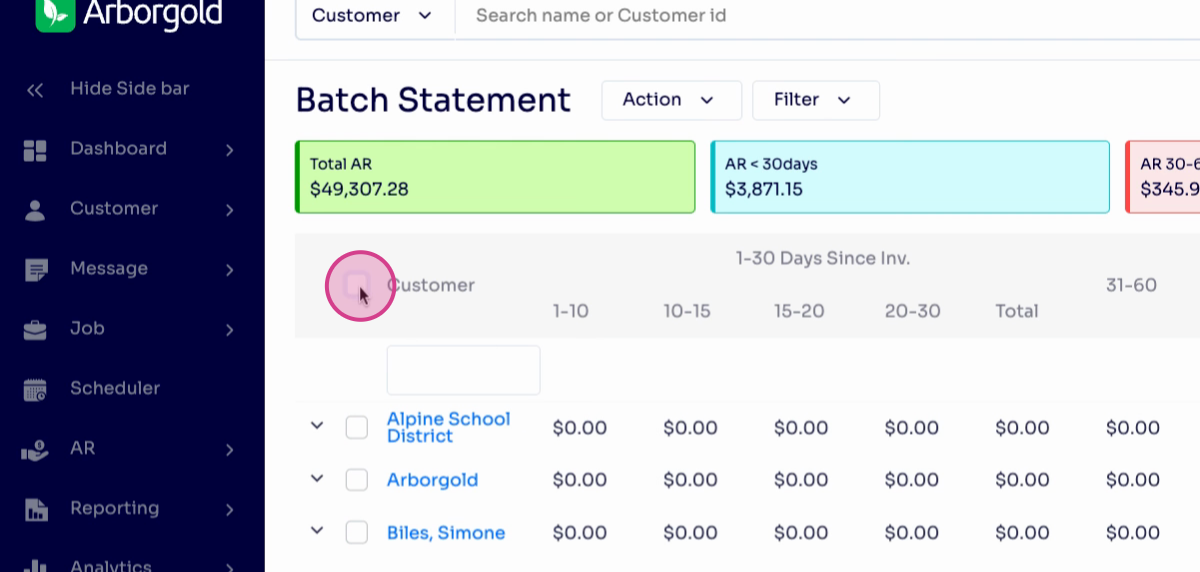

Step 12: Use the top box to select all customers for a batch process.

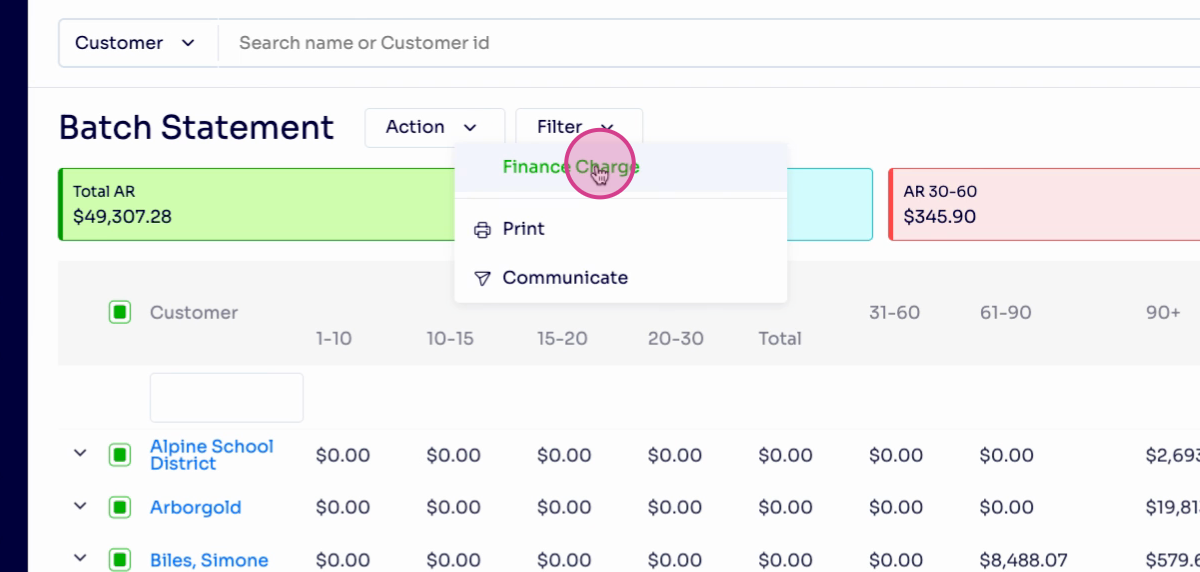

Step 13: Under Action, select Finance Charge and confirm with Yes. This applies finance charges to overdue accounts based on your settings.

Frequently Asked Questions (FAQs)

1. How do I override global finance charge settings for a specific customer in Arborgold? Go to the customer's profile in Arborgold. Under their account settings, you'll see sections for finance charges. Enter custom rates, minimums, or terms as needed. Save your changes—these new settings override the global defaults for that customer when finance charges are calculated.

2. What happens if a payment is made before a finance charge is applied? When a customer pays off their invoice before the finance charge is processed, Arborgold doesn't assess a finance charge for that invoice, regardless of due date. Only balances still outstanding at the time of finance charge processing are charged.

3. Can I reverse or waive a finance charge after it has been applied? Yes. Find the finance charge entry on the customer's account or invoice ledger and either credit or mark it as waived—whichever your process allows. Always document the adjustment's reason for clear records.