Arborgold Payments (Setup & Enrollment) How to enroll to Arborgold Payments Setup & Rates Caleb

Arborgold Payments allows you to accept credit card payments at no cost to your business and debit & ACH payments at low rates.

Watch the video below to sign up in Arborgold Software.

Table of contents:

Accepting Bank Transfers or eChecks (ACH)

Gross Funding: Fees & Expenses

Enable Notifications for Disputes

Enrollment Instructions

Access Arborgold Payments in settings.

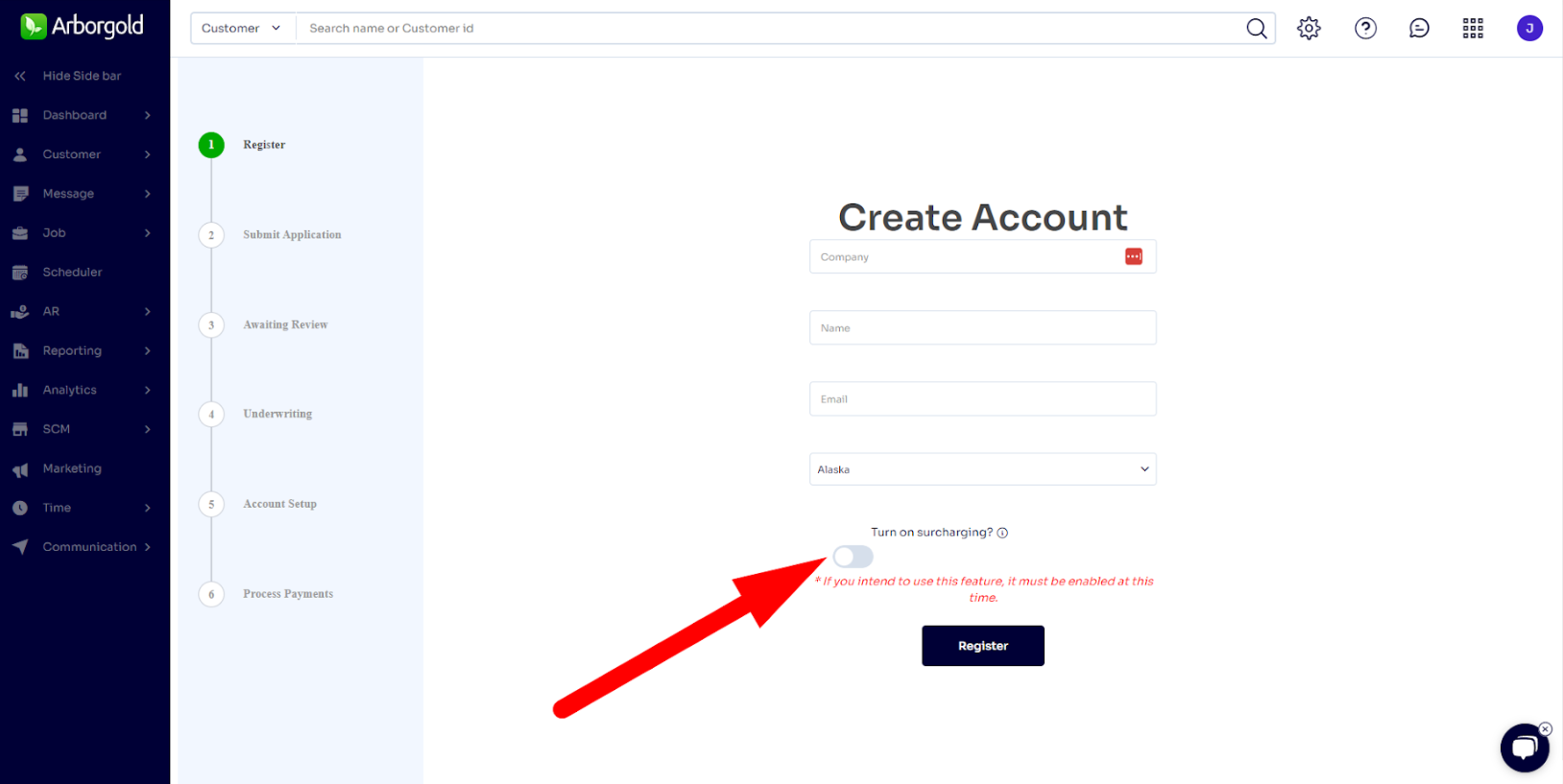

In your Arborgold site, head to the gear cog and head to Integrations > Arborgold Payments > Set Up

IMPORTANT: At the beginning of the application, please make sure you select "Impose CC surcharge fee" if you want to surcharge your customers (shown in the attached image). If this is missed and the account is created, there would be a $150.00 fee for getting it enabled for your account.

From here you can fill out the application and submit it, and we should respond within a few business days. For updates and further questions, you can contact nick@arborgold.com

Fill out the application

Click Submit Application on the page and it will open a new tab where you can finish the application. It will take you 5 minutes to complete. Please note existing customers' cards saved on the account will not be saved in the processor transfer.

Surcharging

On the first page, it will offer surcharging, which will allow you to pass on the payment processing fees to your customers.

In the non-surcharging account option, the merchant (you) pay...

- Debit / Credit Cards - 2.80% + $0.20/transaction to be paid by merchant.

- ACH - 1% + $0.30/transaction Capped at $15 max/transaction to be paid by merchant.

In the Surcharging account option...

- Credit Cards - 3% surcharge fee paid by customer while processing.

- Debit Cards - 2.91% + $0.20/transaction to be paid by merchant.

- ACH - 1% (capped at $15) + $0.30 / transaction to be paid by merchant

NOTE: Surcharging is not allowed / available in Massachusetts or Connecticut, but is an option in all other states.

After surcharging: - Visa, Mastercard debit cards or any other debit card can not be surcharged by law and therefor the client will be responsible for the fees on those transactions.

"A Monthly minimum fee of $20 will be charged to merchants who don’t process any payments for more than 90 days."

Fill out credit card forms for Mastercard

After completing the application process, you will be required to fill out the form for Mastercard for compliance.

Getting approved

You will be notified if we need supporting documents or if your application was approved.

Contact us for help

If you need any help during the application process, feel free to contact our support team at 812-269-8402 or email us at [email protected] .

Accepting Bank Transfers and eChecks (ACH)

eChecks or ACH payments can be processed with Arborgold Payments. In order to set this up, you will need to have completed the application above and been approved.

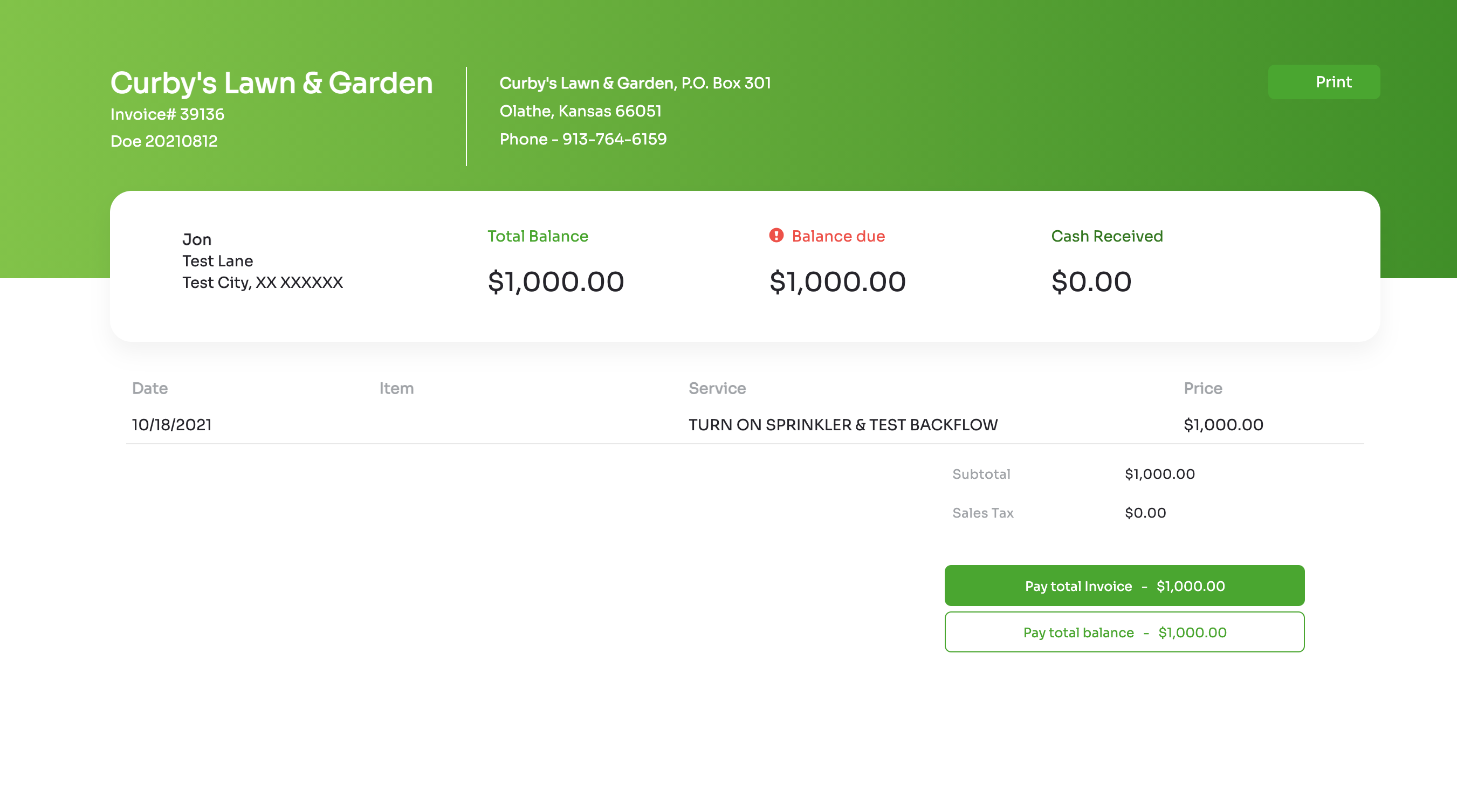

Once you have been approved and send out an E-Invoice, the option to “Pay Now” will appear on your invoices.

Your customer will click “Pay Now” and the options to pay will appear on the screen.

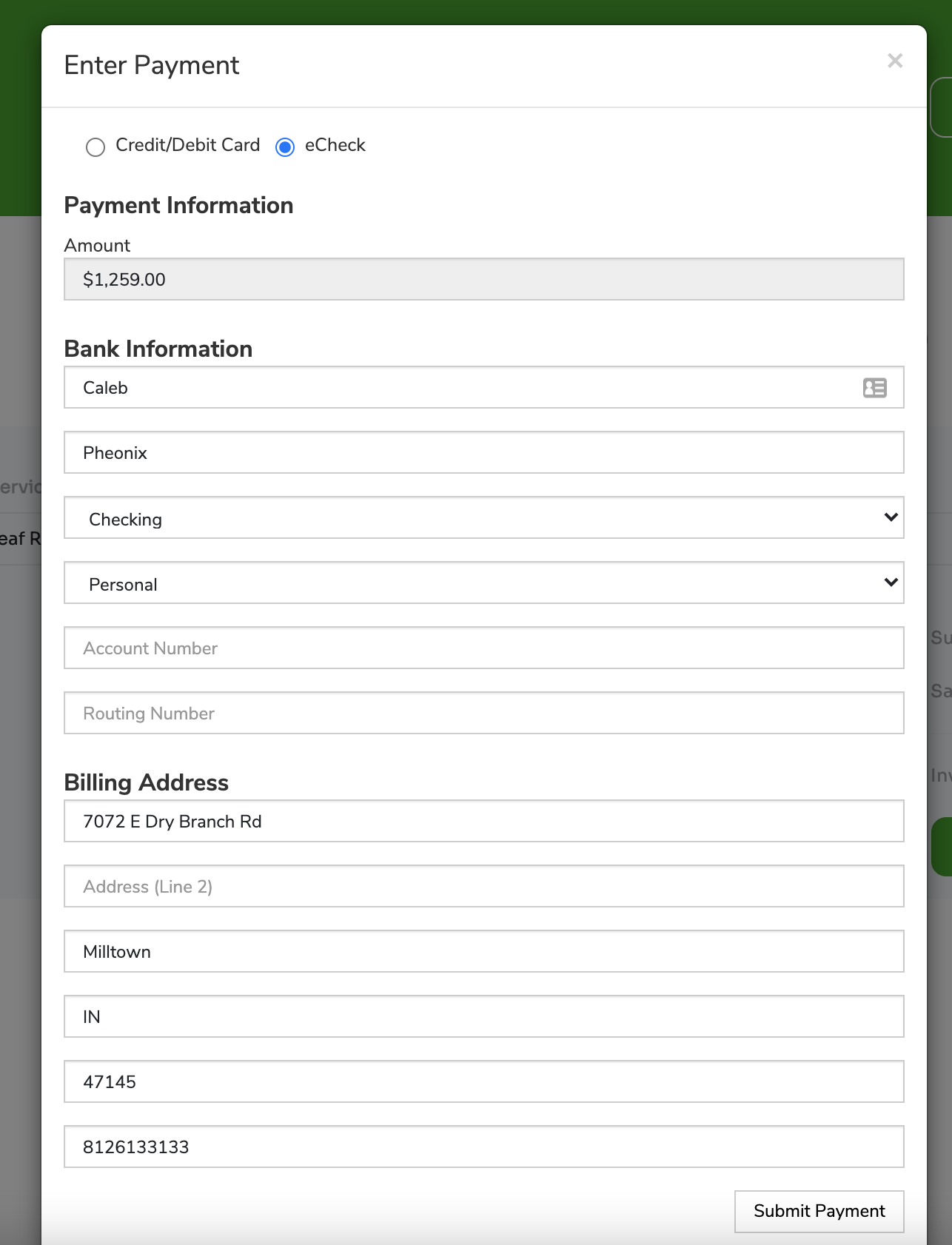

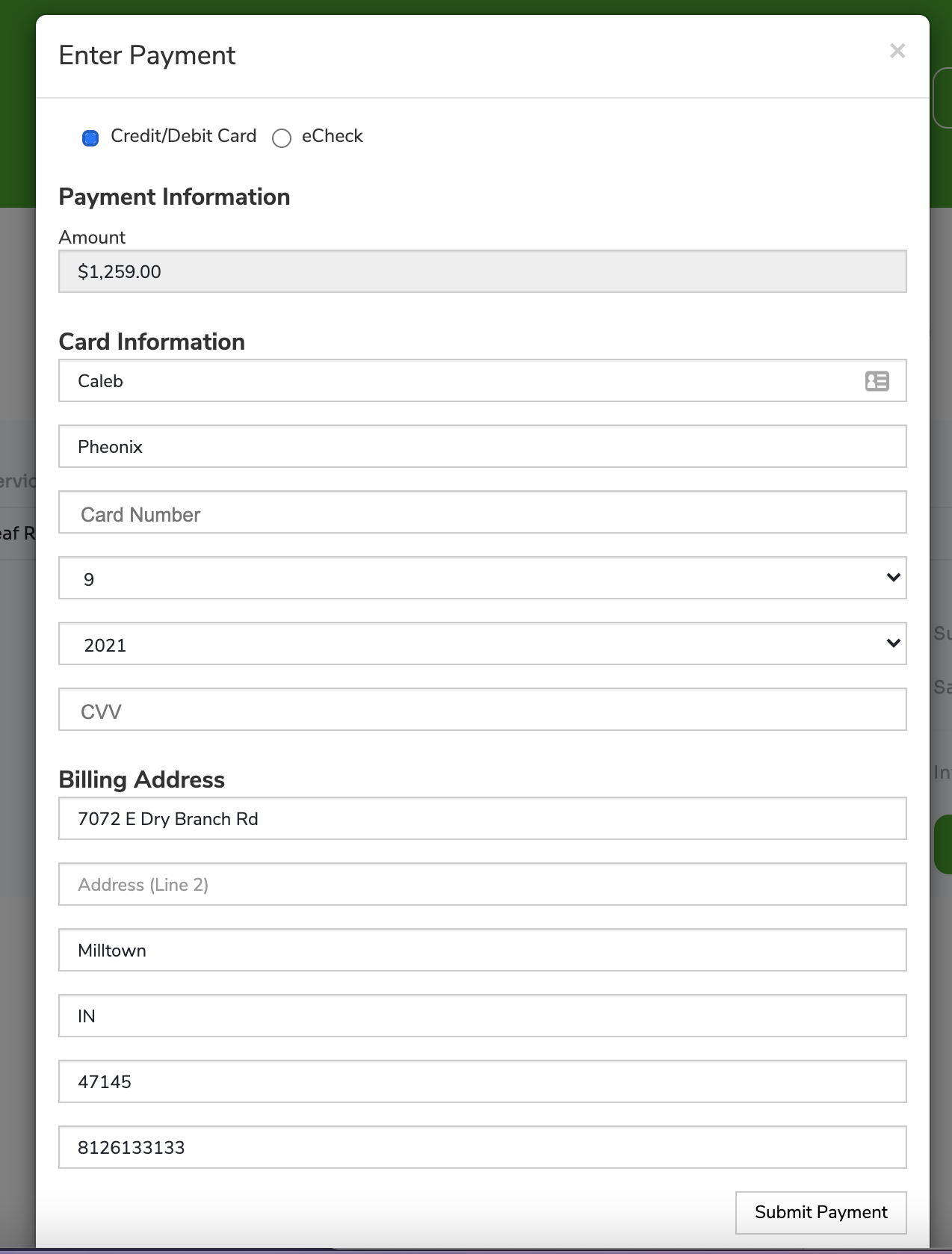

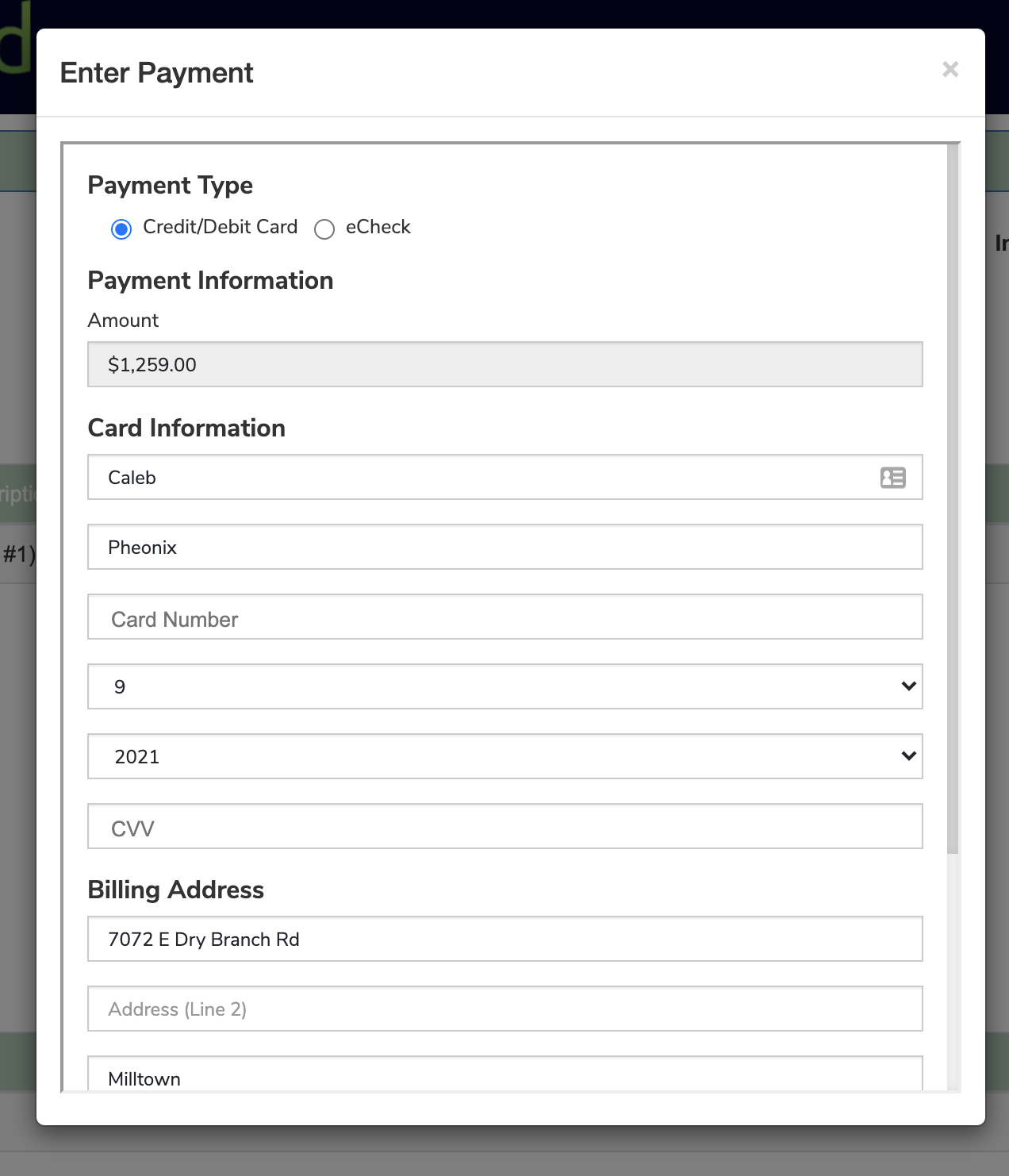

Choose the second option, eCheck. You will now enter in the checking account number, routing number, and billing address and click “Submit Payment”

Accepting Credit Cards

Credit cards can also be accepted with Arborgold Payments. In order to set this up, you will need to have completed the application above and been approved.

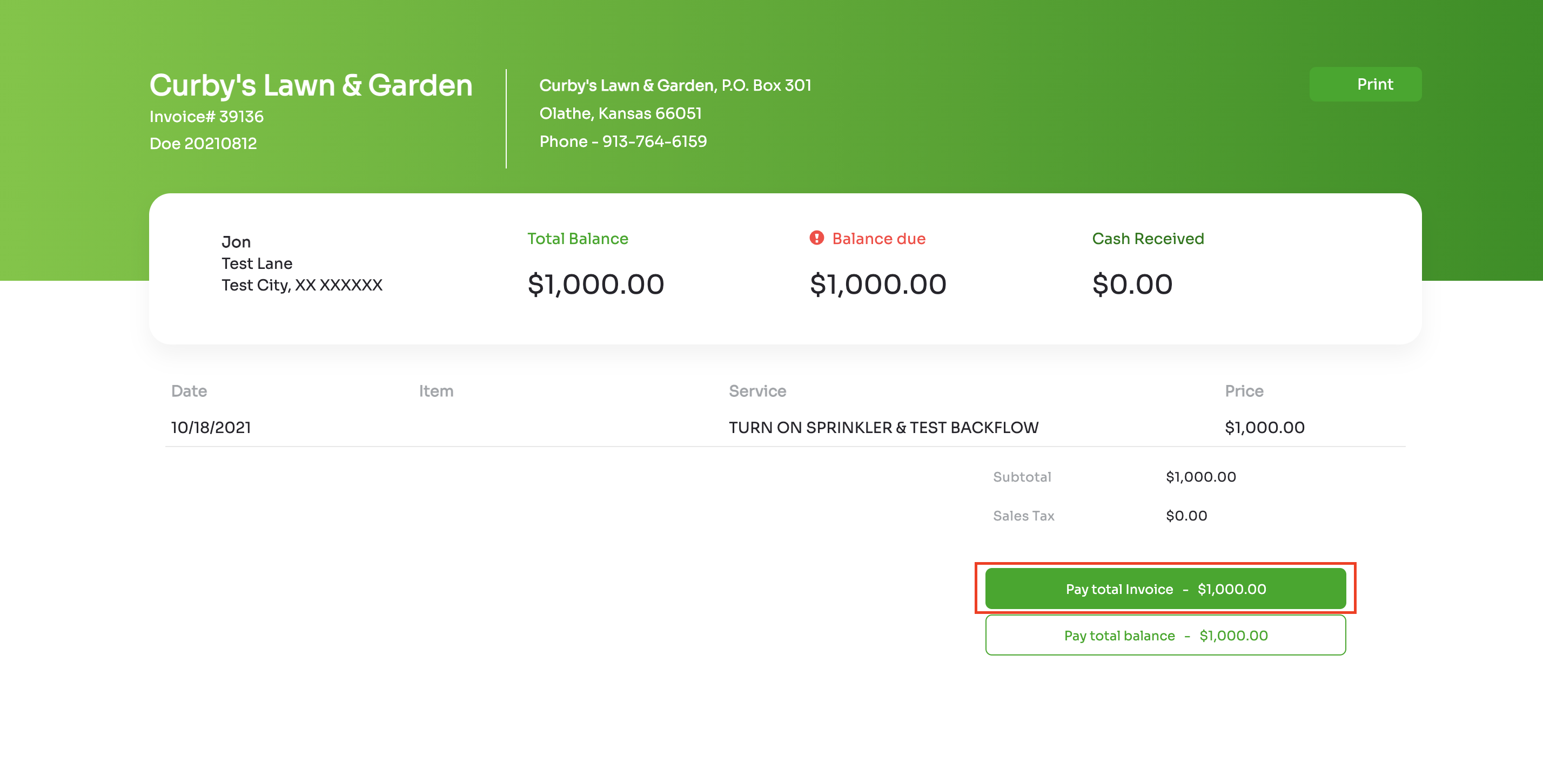

Once you have been approved and send out an E-Invoice, the option to “Pay Now” will appear on your invoices.

Your customer will click “Pay Now” and the options to pay will appear on the screen.

Choose the first option, Credit Card. You will now enter in the credit card details and billing address and click “Submit Payment”

Accepting ACH or Credit Cards in the Customer Portal

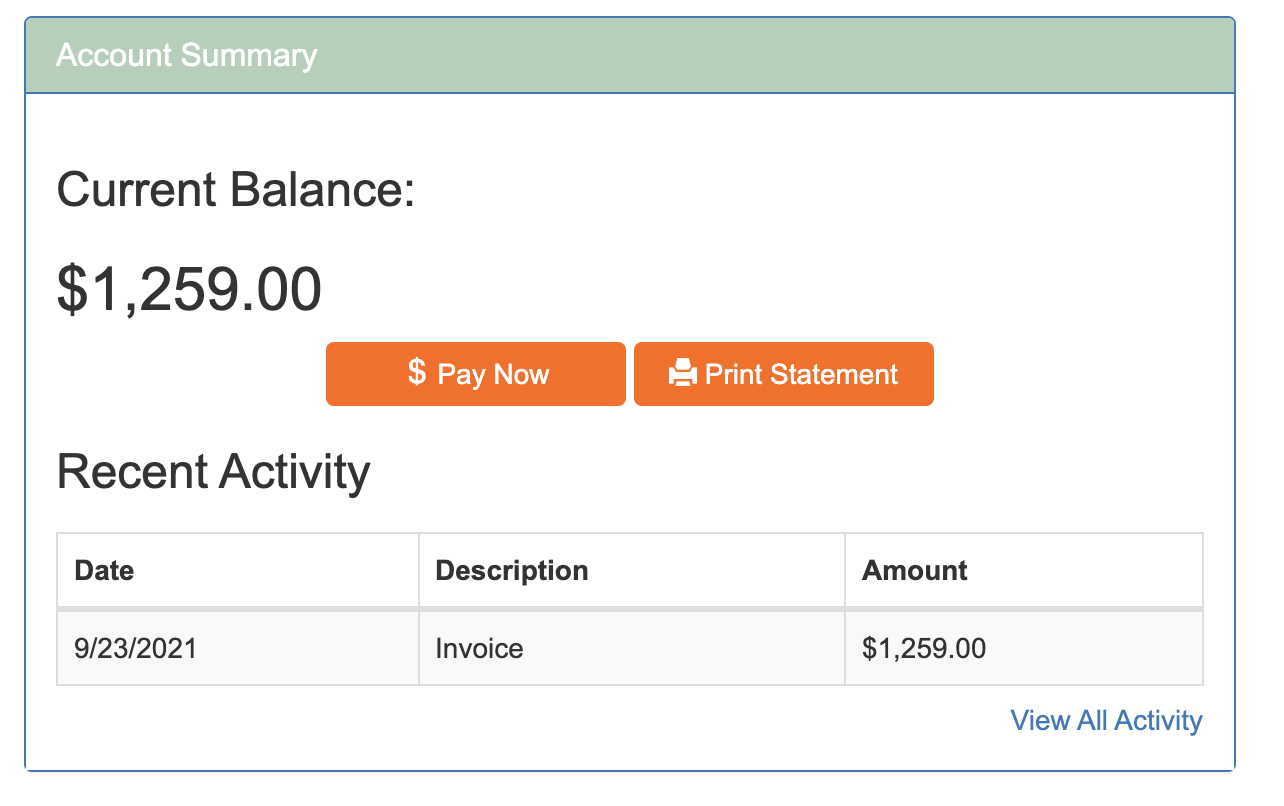

If your Arborgold Subscription is Professional or Enterprise, your site will have the Customer Portal feature.

This will allow your customer to login 24/7 to pay any open invoices or request work from their dedicated login.

Within the Customer Portal, your customer will see any unpaid invoices, and have the ability to “Pay Now”

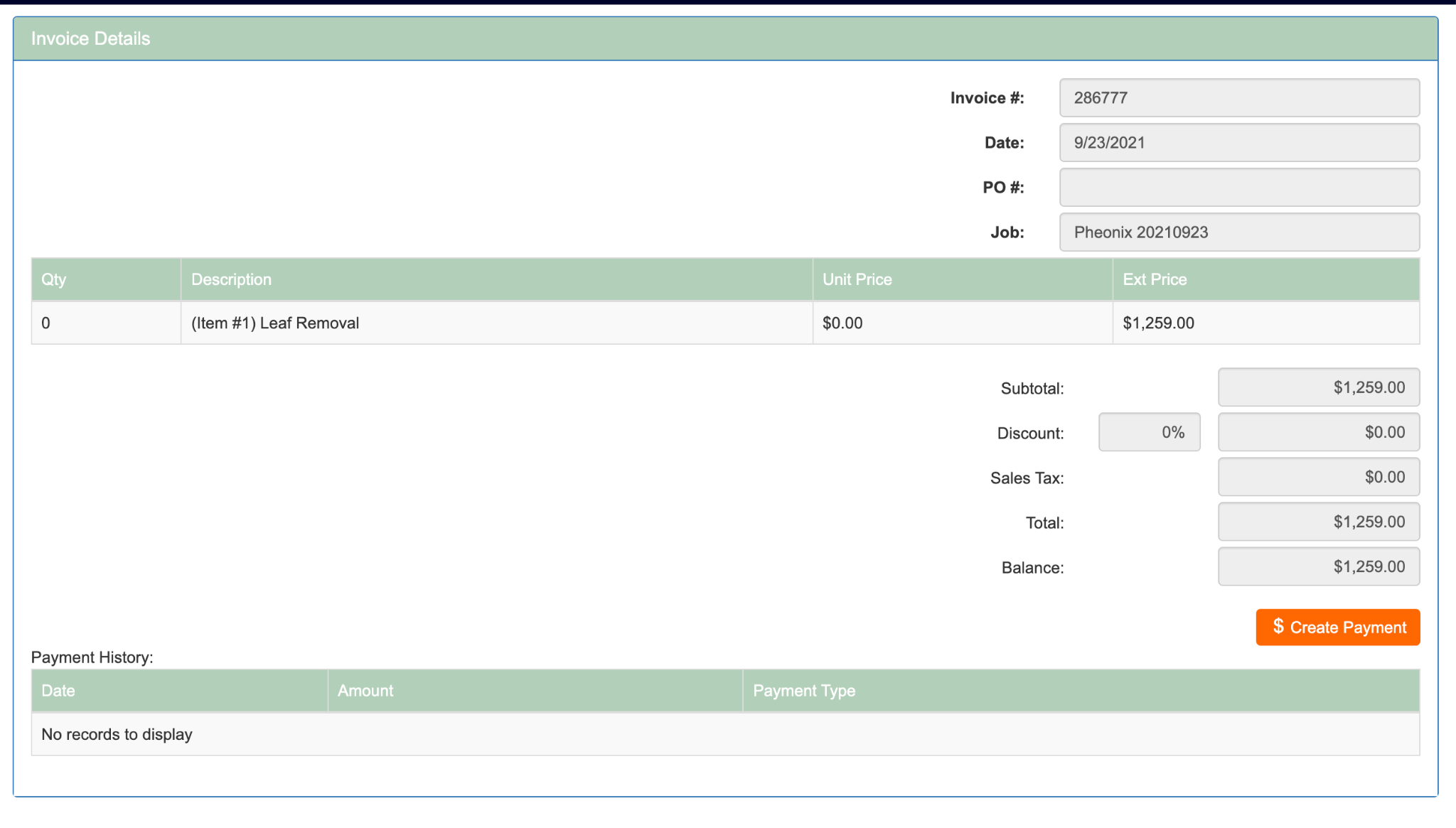

The invoice will open for your customer.

To make a payment, click “Create Payment” in the bottom right and the same payment form will appear.

Enter the payment as a credit card or eCheck (ACH) Bank Transfer and click “Submit Payment”

Fees debited from Payments: Gross Funding

Gross Funding

Your account has automatically been set up to receive gross deposits. Gross funding is when the deposits in your bank account match your daily batch totals.

For example, if you ran $1,000 in transactions in a single day, and your fees totaled $29, you would see a single deposit of $1,000 to your bank account, followed by a single debit of $29. The net amount would then total $971.

This makes reconciliation much simpler within your bookkeeping system of choice.

Transactions taken by 8:00pm EST each day will be funded to your bank account within 48 business hours for credit card transactions, and 5 business days for ACH transactions.

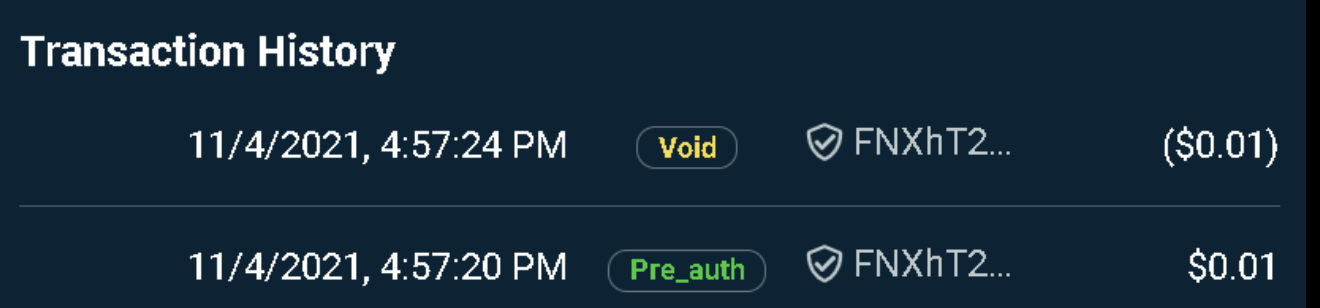

Card Pre-Authentication: $0.01 voided transactions

When adding a new card on file, Arborgold will pre-authenticate the card with a $0.01 transaction and then immediately void it. This is to ensure the card is valid and there are funds available in the account when saving a card on file.

Note: Arborgold's E-Payment Summary screen will not include these transactions to avoid irrelevant charges filling up the screen.

Arborgold Payments: Enabling Notifications

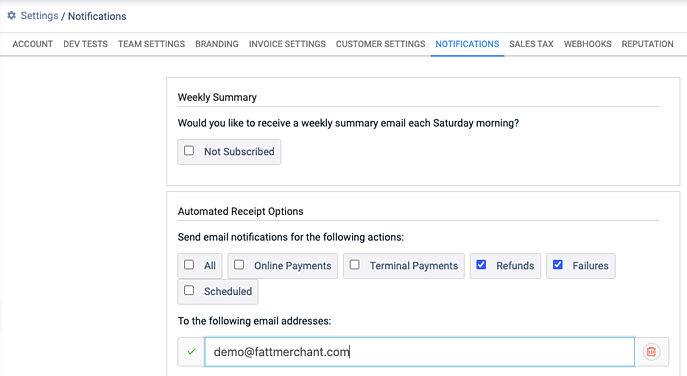

You have the ability to be notified of certain actions taken in Arborgold Payments.

Actions include:

-

A payment has been received via your online payments link

-

A refund has been processed

-

A transaction has failed

-

A scheduled payment has been processed

-

A card present payment has been processed (if applicable)

You can also receive weekly summaries every Saturday.

To set up automated reminders, follow the steps below:

-

Go to your Payments Dashboard in Arborgold

-

Select Settings from the main toolbar

-

Select Notifications

-

Select the actions that you would like to be notified of when completed

-

Enter the email address that should receive the notifications

-

Click Save

If you currently have a merchant account with a different third party processor but would like to sign up with Arborgold Payments and get all your saved customer cards migrated over to your new Arborgold Payments merchant account, the request has to be raised by you (Account Holder) to your current processor.

There may be a fee that your current processor may charge you for the migration process.

If you have any further questions or need additional assistance, you can call our Support Team at (812) 269-8402 or email [email protected] .

Did this answer your question?